Change value during the period between open outcry settle and the commencement of the next day's trading is calculated as the difference between the last trade and the prior day's settle. Sources: FactSet, Tullett PrebonĬommodities & Futures: Futures prices are delayed at least 10 minutes as per exchange requirements. Sources: FactSet, Tullett PrebonĬurrencies: Currency quotes are updated in real-time. Sources: FactSet, Dow Jonesīonds: Bond quotes are updated in real-time.

Sources: FactSet, Dow JonesĮTF Movers: Includes ETFs & ETNs with volume of at least 50,000. Stock Movers: Gainers, decliners and most actives market activity tables are a combination of NYSE, Nasdaq, NYSE American and NYSE Arca listings. Overview page represent trading in all U.S. Indexes: Index quotes may be real-time or delayed as per exchange requirements refer to time stamps for information on any delays. Copyright © FactSet Research Systems Inc. Fundamental company data and analyst estimates provided by FactSet. International stock quotes are delayed as per exchange requirements. stock quotes reflect trades reported through Nasdaq only comprehensive quotes and volume reflect trading in all markets and are delayed at least 15 minutes. NASDAQ does not use this value to determine compliance with the listing requirements.Stocks: Real-time U.S. "Market Cap" is derived from the last sale price for the displayed class of listed securities and the total number of shares outstanding for both listed and unlisted securities (as applicable). It does not include securities convertible into the common equity securities. Market Cap (Capitalization) is a measure of the estimated value of the common equity securities of the company or their equivalent.

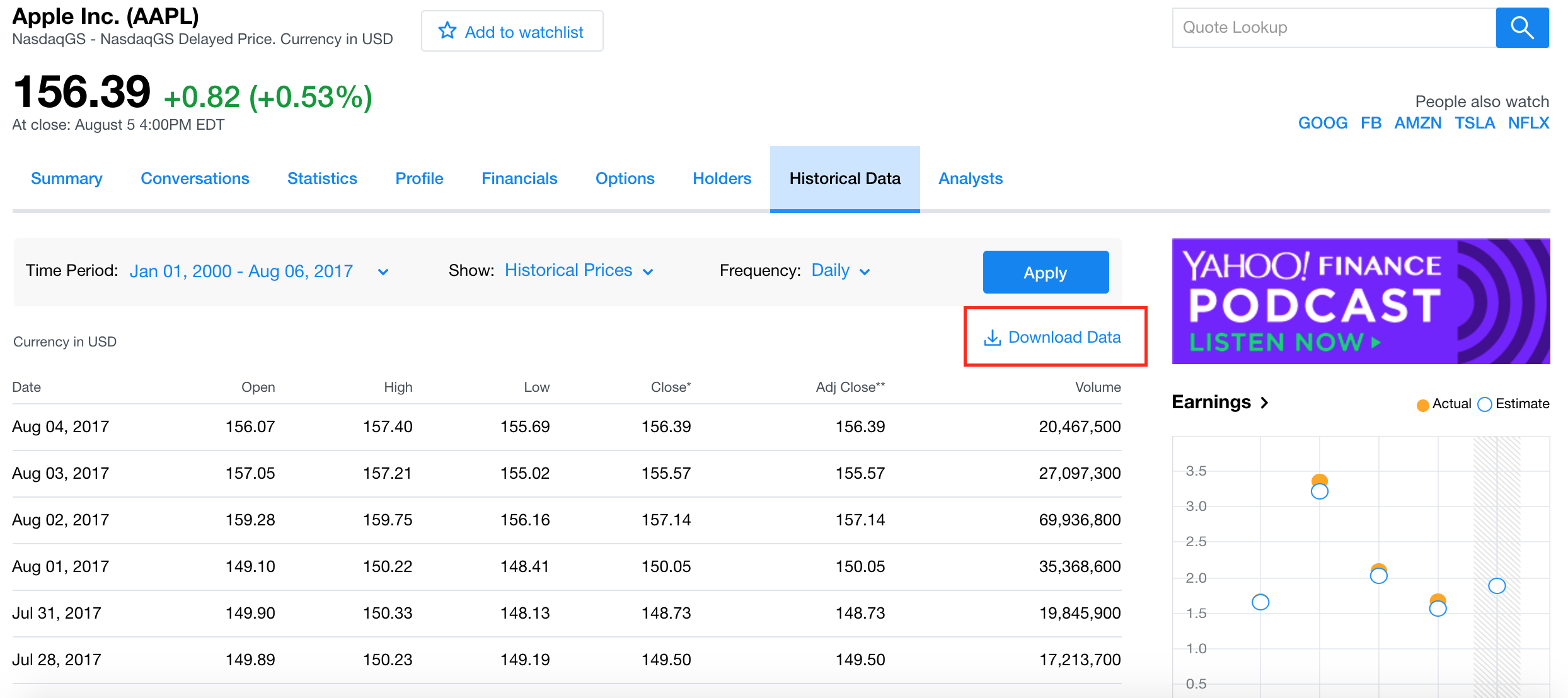

#Historical stock prices yahoo free

Register for your free account today at. Data Link's cloud-based technology platform allows you to search, discover and access data and analytics for seamless integration via cloud APIs.

0 kommentar(er)

0 kommentar(er)